KreditBee Personal Loan In today’s fast-paced world, financial needs can arise unexpectedly. Whether it’s for medical emergencies, education, wedding expenses, or simply to manage a cash crunch, personal loans offer a convenient solution. Among the many options available, KreditBee has emerged as a reliable platform for obtaining quick and hassle-free personal loans. This comprehensive guide will walk you through everything you need to know about KreditBee personal loans, from features and benefits to the application process and repayment options.

What is KreditBee?

KreditBee is a digital lending platform that offers instant personal loans to salaried and self-employed individuals in India. The platform is known for its seamless online application process, quick approvals, and flexible loan products tailored to meet various financial needs. With KreditBee, you can apply for a personal loan directly through their website or mobile app, making it a convenient choice for borrowers.

Key Features of KreditBee Personal Loan

- Quick Loan Approval: KreditBee offers instant loan approvals, often within minutes, making it an ideal choice for urgent financial needs.

- Flexible Loan Amounts: Borrowers can avail of loans ranging from ₹1,000 to ₹4 lakh, depending on their eligibility and requirements.

- Short and Long Tenure Options: KreditBee provides flexible repayment tenures ranging from 3 months to 24 months.

- Minimal Documentation: The application process requires minimal documentation, reducing paperwork hassles.

- 100% Digital Process: From application to disbursement, the entire process is conducted online through the KreditBee app or website.

- Secure Transactions: KreditBee ensures data security and privacy through advanced encryption technologies.

Eligibility Criteria for KreditBee Personal Loan

- Age: Applicants must be between 21 to 60 years old.

- Employment: Both salaried and self-employed individuals are eligible.

- Income: A stable monthly income is required.

- Documents Required: PAN Card, Address Proof (Aadhaar, Passport, Utility Bills), Income Proof (Salary Slips, Bank Statements).

How to Apply for a KreditBee Personal Loan

- Download the KreditBee App: The app is available on both Android and iOS platforms.

- Register and Fill Application Form: Provide personal, professional, and financial details accurately.

- Upload Documents: Submit required documents for verification.

- Verification and Approval: KreditBee’s digital system verifies the information instantly.

- Disbursement: Once approved, the loan amount is credited directly to your bank account.

Repayment Options

KreditBee offers multiple repayment methods including:

- EMI through Debit Card: Setup auto-debit for hassle-free repayments.

- UPI and Net Banking: Pay your EMIs using digital payment methods.

- Wallets and Payment Apps: KreditBee also accepts payments through popular wallets.

Pros and Cons of KreditBee Personal Loan

Pros:

- Instant approvals and disbursements

- Flexible loan amounts and tenures

- Minimal documentation

- Transparent fee structure

- No collateral required

Cons:

- Higher interest rates for lower credit scores

- Limited to Indian residents only

Tips to Increase Your KreditBee Loan Approval Chances

- Maintain a good credit score

- Ensure all documents are accurate and updated

- Avoid multiple loan applications at once

- Opt for a loan amount that matches your repayment capacity

Conclusion

KreditBee personal loans provide a quick and efficient solution for managing financial needs. With a user-friendly digital process, competitive interest rates, and flexible repayment options, KreditBee stands out as a reliable choice for borrowers. Whether it’s an emergency or planned expense, KreditBee’s instant personal loans can offer the financial support you need. Apply today and experience the convenience of hassle-free borrowing.

By following this guide, you can make an informed decision about whether KreditBee is the right choice for your financial needs. Remember to borrow responsibly and assess your repayment capacity before applying for any loan.

Related Posts

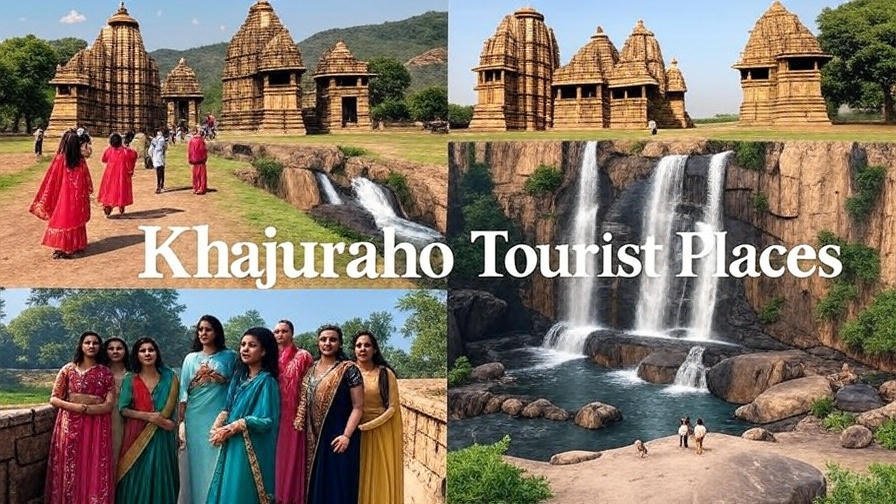

- Khajuraho Tourist Places: A Complete Travel Guide

- CASHe Personal Loan: A Comprehensive Guide for Easy and Fast Financing

- Jabalpur tourist places : A Comprehensive Guide to Tourist Places in Jabalpur

- MoneyTap Personal Loan: Everything You Need to Know

- investkraft personal loan

नमस्ते दोस्तों! मेरा नाम मनोज मीना है और मैं एक ट्रैवल ब्लॉगर हूं। मुझे नई-नई जगहों की खोज करना, उनके बारे में जानकारी जुटाना और उसे आप तक पहुंचाना पसंद है। इस ब्लॉग पर आपको भारत और विदेश की बेहतरीन जगहों, टूर पैकेज, tour टिप्स और गाइड्स की जानकारी मिलेगी, जिससे आपकी अगली trip आसान और यादगार बन सके। आप मुझे इंस्टाग्राम और फेसबुक पर भी फॉलो कर सकते हैं।